In Denver, facing unexpected financial urgencies? A Bridge Loan Denver offers swift, flexible short-term financing to cover immediate gaps until a longer-term solution is available. With quick turnaround (often within 24 hours) and manageable repayment periods from weeks to months, these loans provide much-needed financial flexibility for temporary cash flow issues, home repairs, or business opportunities. Compare bridge loan Denver options to secure competitive interest rates tailored to your situation.

“In today’s dynamic financial landscape, immediate cash flow needs can arise unexpectedly. This is where bridge loans in Denver step in as a flexible solution. Our article explores how these short-term loans operate, providing a clear guide for understanding their benefits and considerations. From unlocking liquidity to catering to diverse financial scenarios, we delve into why a Denver bridge loan could be the ideal choice for navigating through temporary financial challenges.”

- Understanding Bridge Loans in Denver: Unlocking Flexibility for Immediate Financial Needs

- How Do Short-Term Loans with Flexible Terms Work? A Step-by-Step Guide

- Benefits and Considerations: Why Choose a Bridge Loan in Denver for Your Financial Situation

Understanding Bridge Loans in Denver: Unlocking Flexibility for Immediate Financial Needs

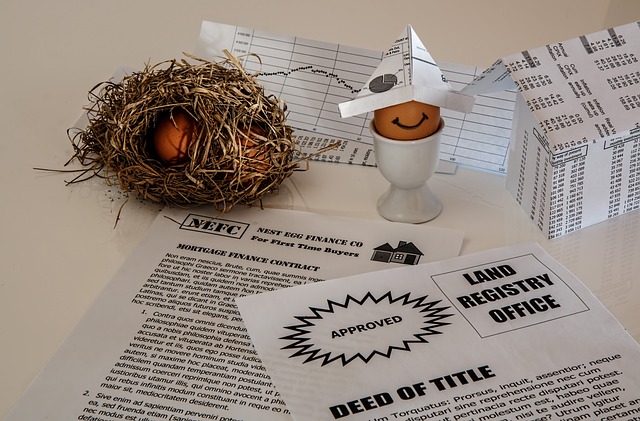

In Denver, like many urban centers, financial needs can arise unexpectedly, demanding immediate attention. This is where a bridge loan denver steps in as a flexible solution. A bridge loan is a short-term financing option designed to cover urgent financial gaps until a longer-term loan or source of income becomes available. It offers a unique advantage by providing funds with adaptable terms, allowing borrowers to repay at their own pace without the pressure of strict repayment schedules.

This type of loan is particularly beneficial for Denver residents facing temporary cash flow issues due to unexpected expenses, home repairs, or business opportunities. With a bridge loan denver, individuals can unlock the financial flexibility needed to navigate these situations. Lenders understand that life is unpredictable, and their goal is to provide a readily accessible resource, ensuring borrowers maintain control over their finances while addressing immediate concerns.

How Do Short-Term Loans with Flexible Terms Work? A Step-by-Step Guide

Short-term loans with flexible terms offer a practical solution for individuals and businesses in need of quick financial support. These loans are designed to bridge the gap between paychecks, covering unexpected expenses or short-term financial needs. In Denver, where the cost of living can be high, a bridge loan can provide much-needed relief during times of financial strain.

Here’s how these loans work: First, borrowers apply for a short-term loan from a lender offering flexible terms. Upon approval, the lender dispenses the funds, usually within 24 hours. The loan is structured to be repaid in installments over a set period, often ranging from weeks to months. This flexibility allows borrowers to manage their debt more comfortably by breaking down the repayment into manageable chunks. Key benefits include instant access to capital and customizable repayment plans tailored to individual needs, making them ideal for those seeking a bridge until their next pay check or a longer-term financial solution.

Benefits and Considerations: Why Choose a Bridge Loan in Denver for Your Financial Situation

In today’s unpredictable financial landscape, Denver residents often seek flexible solutions to navigate unexpected expenses or short-term cash flow gaps. This is where bridge loans in Denver step in as a valuable tool. A bridge loan offers a quick and accessible way to borrow money for immediate needs, providing a safety net until your next source of income or a more permanent financing option becomes available.

Choosing a bridge loan can have several advantages. Firstly, they are designed with flexibility in mind, allowing borrowers to access funds quickly and repay them over a shorter term. This is particularly beneficial for unexpected events like medical emergencies, home repairs, or covering education costs. Additionally, Denver’s competitive lending market ensures that many bridge lenders offer attractive terms, including lower interest rates compared to traditional short-term alternatives. When considering a bridge loan in Denver, it’s important to evaluate your financial situation, compare lenders, and understand the repayment terms to make an informed decision tailored to your needs.

Bridge loans Denver offer a practical solution for immediate financial needs, providing flexibility and swift access to funds. By understanding the step-by-step process and weighing the benefits against considerations, you can make an informed decision about whether a short-term loan with flexible terms is the right choice for your unique financial situation. For those seeking a reliable and accessible lending option in Denver, exploring bridge loans could be a game-changer.