Flexible repayment options for bridge loans in Denver offer borrowers control over payments, adapting to economic uncertainty and life events. This approach fosters trust between lenders and customers by enabling them to manage finances sustainably during dynamic economic landscapes, catering to residents' unique financial needs.

Flexible repayment terms offer a breath of fresh air for individuals navigating financial complexities. In today’s dynamic economic landscape, unexpected expenses can arise, making traditional loan structures less adaptable. This is where Bridge Loan Denver steps in as a game-changer. By providing flexible repayment options, Denver residents can now access much-needed funds without the rigid constraints. Understanding these terms empowers borrowers to manage their finances effectively, ensuring a smoother financial journey.

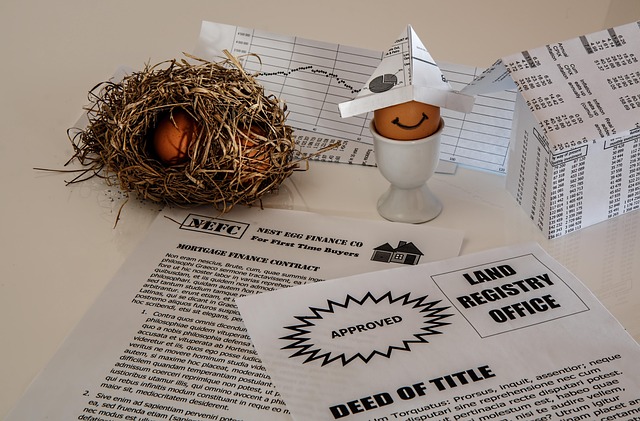

Understanding Flexible Repayment Terms

Flexible repayment terms have become increasingly popular, especially in the financial services sector. In the context of a bridge loan Denver residents might seek, these terms offer borrowers more control and flexibility over their loan repayments. This can include options like making smaller, more manageable payments over an extended period or adjusting repayment amounts based on income fluctuations. Such adaptability is particularly beneficial during times of economic uncertainty or unexpected life events.

Understanding flexible repayment plans allows borrowers to better manage their finances. For instance, a bridge loan with adjustable terms might suit someone looking to invest in a new business venture, allowing them to allocate funds according to the project’s cash flow. This approach ensures that repayments remain sustainable, even if initial financial projections change. By offering these options, lenders cater to diverse customer needs, fostering trust and long-term relationships.

Bridge Loan Denver: Navigating Financial Flexibility

Bridge Loan Denver offers a unique financial solution for those seeking flexible repayment terms. In today’s dynamic economic landscape, flexibility is key, and this type of loan understands that. Whether it’s to cover unexpected expenses or take advantage of business opportunities, Denver residents can navigate their financial needs with greater ease thanks to these tailored loan options.

With Bridge Loan Denver, borrowers gain access to a supportive system that accommodates individual circumstances. The flexible repayment terms allow for customized payment plans, ensuring that the loan fits seamlessly into one’s budget. This approach is particularly beneficial for those facing temporary financial setbacks or looking to manage cash flow effectively while pursuing growth opportunities.

Flexible repayment terms, especially through a bridge loan Denver residents can trust, offer a lifeline in navigating financial challenges. By providing much-needed liquidity and flexible repayment options, these loans enable individuals and businesses to weather unforeseen circumstances. A bridge loan Denver market offers is not just about securing funds; it’s about gaining the flexibility to manage debt responsibly and chart a course for future financial stability.