Bridge loans offer a crucial financial safety net in Denver's dynamic market, filling gaps between property sales and purchases or funding urgent expenses during business transitions. They provide quick access to capital with less stringent credit criteria but come with higher interest rates. To leverage bridge loans effectively, borrowers should assess their financial situation, compare lenders, and prepare necessary documentation for a smooth transition.

In the dynamic financial landscape of Denver, understanding your loan options is crucial for navigating unexpected challenges and seizing opportunities. This article delves into the world of bridge loans, a strategic financial safety net designed for Colorado residents facing transitional periods. We explore when and why a transition between loan types might be necessary, dissecting the differences between traditional loans and bridge loans, and providing a step-by-step guide to ensure a smooth and successful loan transition in Denver.

- Understanding Bridge Loans in Denver: A Financial Safety Net

- When and Why You Might Need a Transition between Loan Types

- Comparing Traditional Loans vs. Bridge Loans: Unlocking the Differences

- Navigating the Process: Steps to Secure a Successful Loan Transition

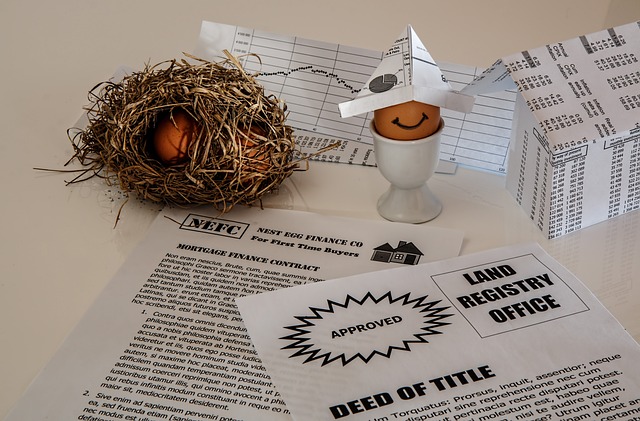

Understanding Bridge Loans in Denver: A Financial Safety Net

Bridge loans, a financial instrument particularly relevant in Denver’s dynamic market, offer a crucial safety net for homeowners navigating transitional periods. These short-term loans are designed to bridge the gap between the sale of an old property and the acquisition of a new one, providing liquidity when traditional mortgage options may be limited. Ideal for situations like a quick relocation, upsizing or downsizing, bridge loans in Denver offer several benefits.

They can cover various expenses associated with the transition, such as down payment on a new home, closing costs, or even temporary housing. Furthermore, these loans are typically easy to obtain, often requiring less stringent credit criteria compared to conventional mortgages. This makes them an attractive option for those who need swift financial support during a real estate shift.

When and Why You Might Need a Transition between Loan Types

In certain financial situations, transitioning between loan types can be a strategic move for individuals and businesses in Denver. A bridge loan, for instance, might be necessary when there’s a gap between one type of financing and another, such as when waiting for a permanent mortgage to close while still needing funds for an upcoming expense. This scenario is common during real estate transactions, where buyers may require immediate funding to secure a property before their long-term loan becomes available.

Additionally, businesses might opt for a bridge loan to navigate cash flow challenges during periods of growth or unexpected economic shifts. It offers a temporary solution to fill the gap between existing debt and new financing options, allowing for continued operations and strategic planning while awaiting more stable funding sources. Thus, understanding when and why to transition between loan types is vital for managing finances effectively in dynamic market conditions.

Comparing Traditional Loans vs. Bridge Loans: Unlocking the Differences

When considering different loan options, understanding the nuances between traditional loans and bridge loans is essential for any borrower in Denver. Traditional loans are straightforward financial instruments with fixed interest rates and a set repayment schedule, making them popular for purchasing real estate. They often require a substantial down payment and are suitable for borrowers with excellent credit history. On the other hand, bridge loans cater to more complex scenarios. These short-term financing options are designed to fill the gap between the sale of one property and the purchase of another, providing liquidity when traditional funding might not be immediately available.

Bridge loans in Denver offer several advantages, especially for real estate investors. They come with flexible terms, allowing borrowers to repay the loan quickly upon securing a permanent mortgage. This makes them ideal for situations where time is of the essence, such as taking advantage of favorable market conditions or facilitating quick property flips. However, these loans typically have higher interest rates and may require collateral, ensuring lenders’ security during the short-term nature of the agreement.

Navigating the Process: Steps to Secure a Successful Loan Transition

Navigating the process of transitioning between loan types can be complex, especially when considering a bridge loan Denver residents might require to cover immediate financial needs. The key to securing a successful transition lies in meticulous planning and understanding each step involved.

First, assess your current financial situation and identify the specific requirements for the new loan type. This includes evaluating the purpose of the bridge loan—is it for home renovation, a business expansion, or another urgent matter? Next, compare different loan options available in Denver to find one that aligns with your needs and offers favorable terms. Researching lenders and their reputation is crucial to ensuring a smooth transition. Additionally, prepare necessary documentation to streamline the application process and increase the chances of approval. Keep in mind that transparency and clear communication with lenders throughout the journey will significantly contribute to a successful loan transition.

Transitioning between loan types, particularly through bridge loans in Denver, can be a strategic financial move for those navigating complex monetary scenarios. By understanding when and how to make this shift, individuals can access tailored solutions that offer both short-term relief and long-term benefits. Whether it’s to capitalize on market opportunities or weather financial storms, a well-planned transition with the help of professional guidance ensures smoother navigation through different loan types, ultimately fostering financial stability and growth in Denver and beyond.