In Denver, bridge loans serve as flexible financial tools for residents and businesses facing short-term cash flow gaps or unique needs. Local lenders offer tailored packages with competitive rates and favorable terms, fostering economic stability and growth by enabling access to necessary resources. These loans provide quick capital for various purposes, from business expansion to home improvements, with manageable monthly payments structured around the borrower's next significant financial event. A strategic approach to selecting a lender is crucial, involving clear need definition, thorough research, and personalized guidance from financial advisors to find the best affordable package.

In today’s diverse financial landscape, tailored loan packages are a game-changer, especially in vibrant cities like Denver. Understanding these flexible financing options can be a bridge to financial security for both individuals and businesses. This comprehensive guide explores the advantages of customized lending, demystifying how bridge loans work, and offering insights into creating effective packages for various sectors. Discover tips on finding the right lender to secure personalized loan deals tailored to Denver’s unique market.

- Understanding Tailored Loan Packages: A Bridge to Financial Security in Denver

- The Benefits of Customized Lending for Individuals and Businesses

- How Bridge Loans Work: Unlocking Immediate Financing Opportunities

- Key Factors in Designing Effective Loan Packages for Different Sectors

- Finding the Right Lender: Tips for Securing Personalized Loan Deals in Denver

Understanding Tailored Loan Packages: A Bridge to Financial Security in Denver

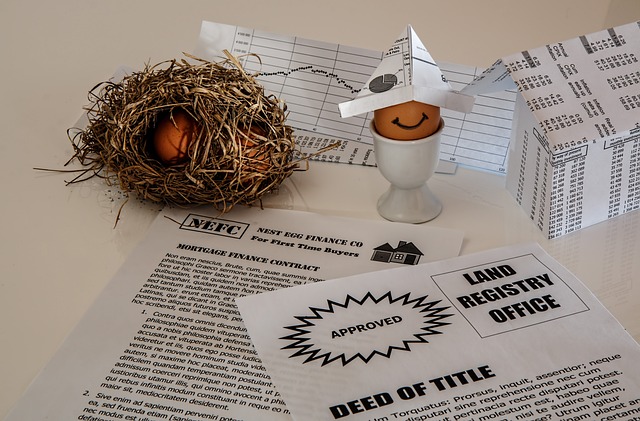

In the vibrant and bustling city of Denver, financial security is a goal many residents strive for, and tailored loan packages serve as a bridge to achieve this. These specialized loans are designed to meet the unique needs of individuals and businesses in a diverse metropolis like Denver, where opportunities and challenges coexist. A bridge loan Denver offers a flexible and customized approach to financing, addressing specific financial constraints that may arise due to the city’s dynamic nature.

Whether it’s for business expansion, home improvement, or unexpected expenses, tailored loan packages provide a safety net. Local lenders in Denver offer these solutions by evaluating borrowers’ individual circumstances, including their income, assets, and credit history, to craft loans that offer competitive rates and favorable terms. This personalized approach ensures that residents of Denver can access the financial resources they need to navigate life’s twists and turns, ultimately fostering economic stability and growth within the community.

The Benefits of Customized Lending for Individuals and Businesses

In today’s diverse financial landscape, one-size-fits-all lending approaches often fall short of meeting the unique needs of individuals and businesses. This is where tailored loan packages step in as a game-changer, especially in cities like Denver where the market dynamics are ever-evolving. A bridge loan Denver lenders offer can be specifically designed to address immediate financial requirements without compromising future growth prospects. For instance, startups or small businesses may require flexible terms to align with their rapid expansion plans, while individuals might seek personalized options for significant life events like home purchases or education funding.

Customized lending provides several advantages. It allows borrowers to access competitive interest rates and favorable repayment conditions tailored to their financial health and goals. For businesses, this means securing funding that supports their specific operational needs without unnecessary burdens. Similarly, individuals can find loan structures that accommodate their unique circumstances, ensuring a smoother borrowing experience and long-term financial stability. Such personalized approaches foster trust between lenders and borrowers, leading to mutually beneficial relationships in a dynamic economic environment, including Denver’s competitive market.

How Bridge Loans Work: Unlocking Immediate Financing Opportunities

Bridge loans in Denver, like elsewhere, offer a unique financing solution for individuals and businesses seeking immediate capital. These short-term loans are designed to bridge the gap between one financial commitment and another, typically providing quick access to funds when traditional loan options may be limited or time-consuming. The process begins with an application where lenders consider various factors such as credit history, income, and asset values to determine eligibility. Upon approval, the loan is disbursed promptly, enabling borrowers to cover urgent expenses or seize timely opportunities.

The beauty of a bridge loan in Denver lies in its flexibility. Borrowers can use the funds for a variety of purposes, from paying off high-interest debt to funding unexpected expenses like home repairs. Repayment terms are usually structured around the time it takes for the borrower’s next significant financial event, such as a sale or expected income, ensuring manageable monthly payments. This immediate financing option is particularly beneficial for those in need of quick cash to navigate through temporary financial challenges or capitalize on market opportunities without delay.

Key Factors in Designing Effective Loan Packages for Different Sectors

Finding the Right Lender: Tips for Securing Personalized Loan Deals in Denver

When seeking a bridge loan Denver residents should approach the process with careful consideration and research. The city’s competitive market means a wide range of lenders, each offering distinct packages. Start by identifying your specific financial needs; whether it’s for home improvement, debt consolidation or an unexpected expense, understanding your requirements will guide your search. Next, compare lenders based on factors like interest rates, repayment terms, and any additional fees. Online reviews can offer valuable insights into a lender’s reputation and customer service.

Utilize local networks and ask for referrals from friends, family, or even your bank; personal recommendations can be a powerful tool. Moreover, consider reaching out to financial advisors who can provide guidance tailored to your situation. Remember, the right lender will offer a package that aligns with your financial goals, providing both flexibility and affordability.

In the competitive financial landscape of Denver, tailored loan packages act as a bridge to securing immediate financing while catering to unique individual and sector-specific needs. By understanding the benefits of customized lending, leveraging the right tools like bridge loans, and selecting the most suitable lender, residents and businesses can access personalized solutions that foster financial security and growth. For those seeking a bridge loan in Denver, navigating these tailored offerings is key to unlocking opportunities and achieving their financial aspirations.