Building strong relationships with lenders offering bridge loans Denver is a strategic move for businesses aiming to grow in competitive markets. These partnerships provide access to short-term funding, stability, and personalized terms, helping businesses manage cash flow, expand operations, and solidify their market position. When seeking a bridge loan Denver, research reputable lenders specializing in tailored solutions, evaluate interest rates and terms, and build trust through honest communication and reliable repayments to ensure favorable financial relationships.

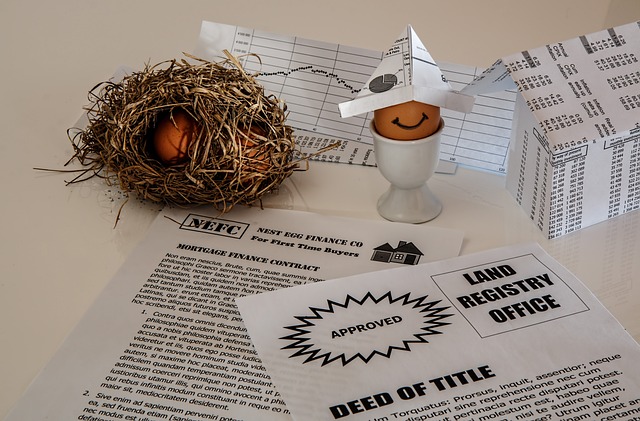

In today’s dynamic financial landscape, establishing and nurturing long-term relationships with lenders is a strategic move for businesses seeking stability and growth. This article delves into the intricacies of building strong ties with lenders, focusing on Denver’s lending market. We explore the benefits of such partnerships, from streamlined access to bridge loans in Denver to fostering trust and transparency. Learn how to select the ideal lender and discover strategies to sustain and grow these valuable financial alliances.

- Understanding Long-Term Lending Relationships

- Benefits of Established Lender Partnerships

- Choosing the Right Lender for Longstanding Relations

- Building Trust and Transparency with Denver Lenders

- Strategies to Sustain and Grow These Financial Partnerships

Understanding Long-Term Lending Relationships

Building and maintaining long-term relationships with lenders is a strategic move for businesses, especially in competitive markets like Denver, where access to capital can be pivotal for growth. These relationships go beyond one-off transactions; they are about fostering trust and understanding between borrowers and lenders. A bridge loan Denver, for instance, isn’t just a temporary financing solution but a stepping stone towards more substantial long-term partnerships.

Lenders who offer these types of loans often look beyond immediate financial health to assess a business’s potential for future success. By doing so, they help businesses navigate challenging periods and support their development over the long haul. This approach benefits both parties, as it encourages stability in the lending market and positions lenders as strategic partners rather than just sources of short-term funding, like a bridge loan Denver might provide.

Benefits of Established Lender Partnerships

Establishing and maintaining strong relationships with lenders offers numerous advantages for businesses, especially when it comes to securing funding for growth and expansion plans. In the competitive market of Denver, where bridge loan denver services are in high demand, having a reliable lender partnership can be a game-changer. These partnerships provide a steady stream of capital, enabling businesses to access short-term financing options swiftly and efficiently. With a pre-existing relationship, companies can navigate financial challenges with ease, ensuring they have the resources needed to bridge gaps between funding cycles.

Moreover, long-term partnerships foster transparency and trust. Lenders who understand a business’s unique needs and goals can offer tailored solutions, such as customized loan terms and favorable interest rates. This level of partnership enhances cash flow management and provides businesses with financial stability, allowing them to focus on core operations while exploring new opportunities, whether it’s expanding into new markets or developing innovative products.

Choosing the Right Lender for Longstanding Relations

When establishing lasting relationships with lenders, especially for complex financial needs like a bridge loan Denver, it’s crucial to choose a partner that aligns with your long-term goals. Research and select a lender renowned for their stability, expertise in specialized loans, and a history of transparent, ethical practices. Look for institutions specializing in bridge loans, as they have the experience to navigate unique financial scenarios and offer tailored solutions.

Consider factors like interest rates, loan terms, and any associated fees when evaluating lenders. Opting for a reputable, experienced lender ensures smoother transactions and fosters trust, setting a positive tone for your ongoing financial partnership. A reliable lender becomes a strategic ally in managing cash flow, funding expansions, or handling unexpected expenses, contributing to the overall success of your ventures.

Building Trust and Transparency with Denver Lenders

Building trust is paramount when exploring a bridge loan Denver residents may need. A strong relationship with lenders fosters transparency, enabling open communication about financial goals and challenges. When seeking a bridge loan Denver banks or credit unions offer, being honest about your current financial standing allows lenders to tailor solutions suited to your unique needs.

This collaborative approach ensures that both parties are aligned, leading to better outcomes for borrowers. Over time, demonstrating reliability and fulfilling repayment obligations strengthens the bond between borrower and lender. Such a solid foundation is crucial when navigating complex financial scenarios and seeking the best possible terms for a bridge loan Denver has available.

Strategies to Sustain and Grow These Financial Partnerships

Sustaining and growing relationships with lenders is paramount for businesses seeking long-term financial stability, especially when considering bridge loan denver options. Building strong partnerships involves open communication, transparency, and demonstrating consistent reliability. Regularly review and assess your financial needs with lenders to ensure alignment. Proactive engagement can help identify potential challenges and opportunities early on, allowing for more flexible and customized solutions.

Implementing strategic initiatives like improving cash flow management, enhancing creditworthiness, and diversifying revenue streams can strengthen these partnerships. Timely repayment of loans and adherence to agreed-upon terms foster trust. Additionally, leveraging technology to streamline financial processes and providing detailed, accurate reporting demonstrate a commitment to transparency, further solidifying the relationship with lenders.

Establishing and nurturing long-term relationships with lenders, such as those offering bridge loans Denver, is a strategic move for businesses aiming for sustained growth. By prioritizing trust, transparency, and mutual benefits, companies can leverage these partnerships to access flexible financing options, navigate market challenges, and capitalize on opportunities. This article has explored the essence of such relationships, highlighting their advantages and providing insights into fostering successful collaborations with Denver lenders. Embracing these strategies ensures businesses stay ahead in a dynamic market landscape.